Portugal Taxes | The 12 main taxes | How to calculate them | How to limit your tax charge?

Are you planning to invest or settle in Portugal? Here is a complete file on the taxes in force in the country, with examples of calculation and application. You will also find all the advice you need to build the best tax model for your situation.

Here are the different taxes covered in this article

1) IRS (Imposto sobre o Rendimento de Pessoas Singulares)

Personal income tax

2) IRC (Imposto sobre o Rendimento de Pessoas Coletivas)

Income tax for legal entities

3) IMI (Imposto Municipal sobre Imóveis)

Housing tax

4) AIMI (Adicional ao Imposto Municipal de Imóveis)

Additional tax on the purchase of a property

5) IMT (Imposto Municipal sobre a Transmissão Onerosa de Imóveis)

Municipal tax on the transfer of property

6) IS (Imposto de Selo)

Stamp duty

7) Property capital gains tax

8) Inheritance and gift tax

9) Wealth tax

10) IVA (Imposto sobre o Valor Acrescentado)

VAT (value added tax)

11) ISV (Imposto Sobre Veículos)

Vehicle purchase tax

12) IUC (Imposto Único de Circulação)

Single circulation tax

RNH (Non-Habitual Resident) status is not discussed in this document. It is the subject of a specific article called : RNH Portugal Status | What benefits | For whom | How to get benefited?

PORTUGAL TAXES | Everything you need to know to reduce your tax burden

You have just settled in Portugal or are planning to do so soon. You are planning to invest in this high-potential market, but you are not yet familiar with all the tax principles in force. Your taxation in terms of tax charges isn’t completely optimized? Here is a guide that will provide you with all the answers to your questions about taxes in Portugal.

PORTUGAL TAXES | The 12 main taxes in application

1. PORTUGAL TAXES | IRS (Imposto sobre o Rendimento de Pessoas Singulares)

Personal income tax

This tax concerns all persons who receive a salary from a professional activity in Portugal as well as all pensioners who have their main residence in Portugal.

If you do not have the RNH status

The IRS tax is levied directly at source, either as a deduction from your salary or from your pension. It is the responsibility of the company in which you are employed to make the tax deduction from your income.

The calculation of the IRS tax will depend on 3 factors:

- your level of income

- your marital situation

- whether or not you have children

The Portuguese tax authorities have drawn up tables for each of these cases. The amount to be paid varies according to your income and is progressive.

Tabelle 2020 – If you are not married

Tabelle 2020 – If you are a married couple

The other tables are available on the Finance Portal website

Example of IRS tax calculation

The tax is levied on the gross monthly salary, deducted from the relevant allowance.

The tax rate is applied to the amount of net salary obtained.

You must then select from the table the % tax rate corresponding to your net monthly income and the number of dependent children.

If you own property and receive income in the form of rentals, you are also subject to IRS tax.

In this case, the rate applied is 28% on the total amount of rent received over a year, deducted from the maintenance costs of the property and from property tax (IMI).

If you have RNH status

As a pensioner, the tax rate on your retirement pension is 10% over a period of 10 years.

As an active person, the tax rate on your income is 20% over a period of 10 years.

To find out exactly what you need to do to obtain the RNH status, we can consult our complete file by clicking on the button below

2. PORTUGAL TAXES | IRC (Imposto sobre o Rendimento de Pessoas Coletivas)

Income tax for legal entities

This tax concerns companies. It is levied on the net profit made by the company over a financial year.

The tax rate is 17% up to a net profit of EUR 25,000 and 22.5% for higher amounts.

Example of IRC tax calculation

Net operating profit = EUR 15,000

IRC = EUR 15,000 x 17% = EUR 2,550

Net operating profit = EUR 50,000

IRC = EUR 50,000 x 22.5% = EUR 11,250

3. PORTUGAL TAXES | IMI (Imposto Municipal sobre Imóveis)

Housing tax

This is the annual property tax. Taxation is based on the estimated value of the property or assessed value. The tax rate varies from one locality to another and ranges from 0.3% to 0.8%. However, it may not exceed 0.5% for urban buildings. If the property is located in the countryside, the rate can rise to 0.8%

Example of IMI tax calculation

IMI = Value of tax assets (POS) x Applicable rate according to locality

4. PORTUGAL TAXES | AIMI (Adicional ao Imposto Municipal de Imóveis)

Additional tax on the purchase of a property

This is a wealth tax. It is in addition to the IMI. It is calculated on the total amount of the owner’s real estate assets. Only amounts exceeding the value of EUR 600,000 for a single person or EUR 1,200,000 for a couple are taken into consideration. The amount of EUR 600,000 will be deducted from the total value of the real estate assets. This result will be used to calculate the tax

For a single person

The fixed rate is 0.7% if the taxable value of the property is between EUR 600,000 and EUR 1,000,000. It rises to 1% if the taxable value of the property is higher than EUR 1,000,000.

Example of AIMI tax calculation

Tax value of the property portfolio: EUR 750,000

Amount taken into consideration for taxation: EUR 150,000 (EUR 750,000. – EUR 600,000)

Amount of tax: EUR 150,000 x 0.7% = EUR 1,050

Tax value of the property portfolio: EUR 2,000,000

Amount taken into consideration for taxation: EUR 1,400,000 (EUR 2,000,000 – EUR 600,000)

Amount of tax: EUR 1,400,000 x 1% = EUR 14,000

For a couple

The fixed rate is 0.7% if the taxable value of the property is between EUR 1,200,000 and EUR 2,000,000. It rises to 1% if the taxable value of the property is higher than EUR 2,000,000

Example of AIMI tax calculation

Tax value of the property portfolio: EUR 750,000

Amount of tax: EUR 0, as the amount is less than EUR 1,200,000.

Tax value of the property portfolio: EUR 2,000,000

Amount taken into consideration for taxation: EUR 1,400,000 (EUR 2,000,000 – EUR 600,000)

Amount of tax: EUR 2,000,000 x 0.7% = EUR 14,000

5. PORTUGAL TAXES | IMT (Imposto Municipal sobre a Transmissão Onerosa de Imóveis)

Municipal tax on the transfer of property

This tax applies when a property changes ownership. It is borne by the buyer and must be paid before the deed of sale. Proof of payment must be given to the notary when the transaction is signed.

The tax rate will apply to the higher of the acquisition amount and the taxable value of the property.

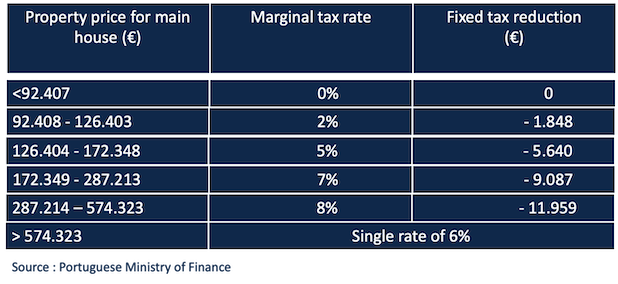

The scale for the calculation of the IMT is as follows:

Example of IMT tax calculationSource: Portuguese Ministry of Finance

For a villa worth EUR 550,000, the tax rate is 5.8%, calculated as follows:

EUR 550,000 x 8% = EUR 44,000

Lump-sum tax reduction = -EUR 11,959

Amount of IMT tax payable = EUR 44,000 – EUR 11,959 = EUR 32,041

i.e. an effective rate of 5.8% (EUR 32,041/EUR 550,000)*100

6. PORTUGAL TAXES | IS (Imposto de Selo)

Stamp duty

Stamp duty is payable on the purchase of a property in Portugal. Like the ITM, it is necessary for the buyer to pay this tax to the notary at the time of signing the deed of sale. The stamp duty is 0.8%. It is applied on the higher of the purchase price of the property and the tax value of the asset.

Example of calculation of the tax on the purchase value of the property

Purchase value of EUR 500,000

Amount of stamp duty to be paid = EUR 500,000 x 0.80%, equivalent to EUR 4,000.

Stamp duty on mortgage loans

If a property loan is granted for the purchase of the property, the buyer must also pay stamp duty on the amount financed. This tax must be paid at the time the financing amount is transferred to the bank account of the client who will purchase a property in Portugal.

In this case, there are two scenarios, namely :

a) For property loans with a repayment period of more than five years, the stamp duty tax is 0.60% ;

b) If the repayment period is less than five years, the rate is 0.50%.

If you would like to find out how to obtain financing from a financial institution, we invite you to discover our article: Real Estate Financing Portugal | Which solutions | Which steps to take?

Example of the calculation of the tax on real estate tax on real estate credit

Loan amount EUR 400,000

Repayment period of more than 5 years

Amount of stamp duty to be paid = EUR 400,000 x 0.60%, equivalent to EUR 2,400.

Loan amount EUR 400,000

Repayment period less than 5 years

Amount of stamp duty to be paid = EUR 400,000 x 0.50%, equivalent to EUR 2,000

7. PORTUGAL TAXES | Tax on property capital gains

This tax is levied at the time of the sale of a property. Provided that the amount of the sale is higher than the amount of the purchase or construction of the property in question.

The previous purchase value of the asset will be adjusted to the rate of inflation recognised during the period of acquisition of the property by the owner.

From the capital gain obtained, all costs incurred in the acquisition of the property can then be deducted: IMT, fees and registration charges, the real estate agent’s commission and any major improvements that occurred in the 12 years preceding the sale.

The tax rate on the amount of capital gain obtained deducted from the above-mentioned expenses is 50%. For non-resident individuals it is 28%. It is set at 25% for non-resident legal entities.

You can avoid paying this tax, in whole or in part, if the property being sold is your principal residence and the capital gain generated is reinvested in the acquisition, improvement or construction of another principal residence in Portugal, the EU or EEA (European Economic Area) area, within 36 months of the sale.

8. PORTUGAL TAXES | Inheritance and gift tax

For inheritances from close family (parents/children/husband)

- The bequeathed property is tax-exempt.

- For donations, a tax of 0.8% is levied on the fiscal value of the gift.

For inheritances affecting other family members or persons

- Bequeathed goods and donations are subject to a one-off tax of 10% on the tax value.

9. PORTUGAL TAXES N°9. Wealth tax

In Portugal, wealth is not subject to tax.

10. PORTUGAL TAXES | IVA (Imposto sobre o Valor Acrescentado)

VAT (value added tax)

Portugal has 3 different VAT rates

The standard rate is 23%.

It is the one most commonly applied.

The intermediate rate is 13%.

It affects all catering services, canned food, petrol and oil painting, and admission to cultural events, exhibitions and sports competitions.

The reduced rate is 6%.

It applies to almost all food, but also to water, literary publications, electricity supply, passenger transport, hotels, medicine and medical equipment.

11. PORTUGAL TAXES | ISV (Imposto Sobre Veículos)

Vehicle purchase tax

Tax levied at the time of purchase of the vehicle. The rate applied varies according to several criteria such as :

- the country of origin of the vehicle

- its power

- the type of fuel used

- CO2 emissions

To get an idea of the amount taxed, you can use the simulation tool by clicking on this link

12. PORTUGAL TAXES | IUC (Imposto Único de Circulação)

Single circulation tax

This tax is payable annually. Like the VSI, the UCI is determined according to the same criteria

You can also make an estimate of the amount to be paid by clicking on this link.

PORTUGAL TAXES | Things to remember

Taxation is a highly important subject, but one that ultimately interests very few people. In their defence, it must be acknowledged that this area of activity is somewhat complex. But great savings can be made, if one pays real attention to it.

You now have a slightly more precise knowledge of the tax practices applied in Portugal. If you need further clarification, do not hesitate to contact a tax advisor. In any case, you will identify sources of optimisation that may enable you to reduce your tax burden.

Thank you for taking the time to read our article through to the end.

If you would like to receive further useful information in preparation for or when buying your property, we invite you to subscribe to our Newsletter. Every month, you will receive a complete file with a wealth of other essential advice to consider before you buy your property.

You can subscribe by clicking on the blue button below.

We look forward to having you as one of our subscribers.

See you soon

VIE D’AZUR