Cost of Living in Portugal | What is my purchase power

Are you planning to settle in Portugal? You have discovered this beautiful country and you have fallen under the spell. The beauty of the landscapes and the kindness of its people have captured you.

But before you start planning your new life, do you know how much money you will spend in Portugal on a daily basis? Have you drawn up a budget to find out how much income you need to live comfortably?

This article provides you with a complete list of prices in 2020 for basic consumer goods, broken down by category (food, housing, energy, taxes, health insurance, telecommunications, mobility, restaurants).

At the end of the document, you will also find a budget simulation for a household consisting of a couple with 2 children, a couple without children and a single person.

COST OF LIVING IN PORTUGAL | FOOD

Portugal is a country rich in natural resources. It has vast areas of vegetable and fruit growing. It has also maintained a large community of livestock breeders and farmers.

As a result, the entire population enjoys quality products on the shop shelves at particularly advantageous prices.

FOOD PRICES

COST OF LIVING IN PORTUGAL | HOUSING

Portugal has been undergoing major transformations in recent years in terms of real estate and housing. Many investors have benefited from the advantages granted by the government to invest their money in the renovation of real estate.

These investments have mainly been made in the country’s major cities. As a result, prices have naturally risen exponentially in these regions compared to other conurbations.

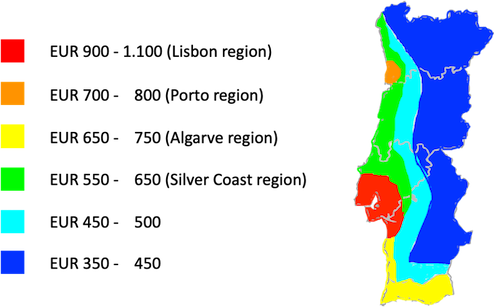

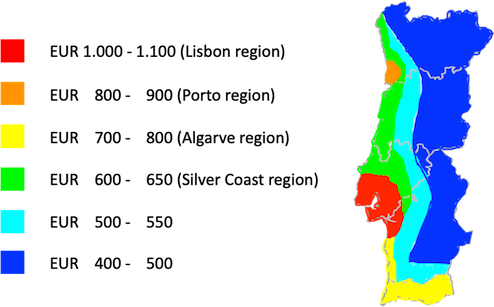

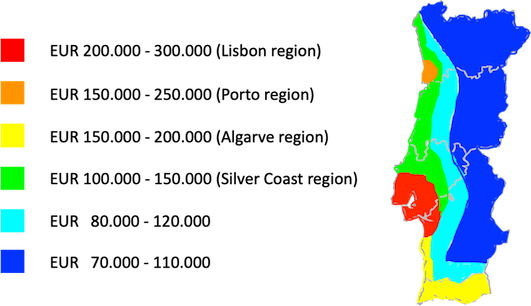

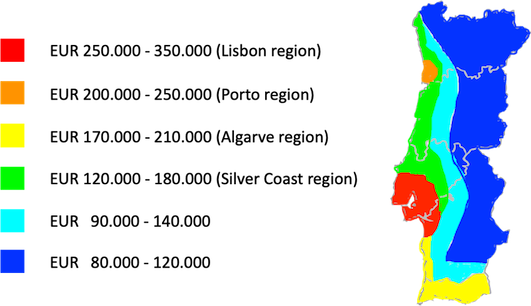

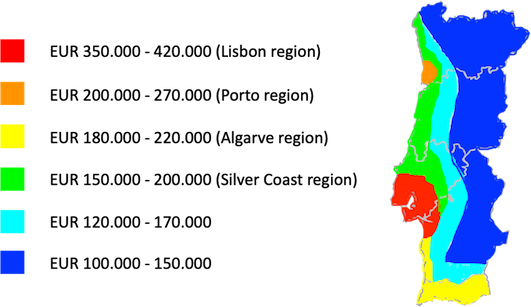

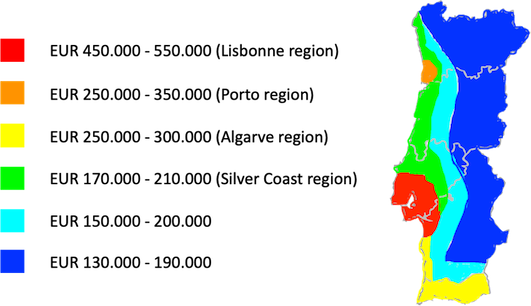

We have drawn up a map of the country with the price variations for housing.

RENTING PRICES/MONTH FOR A 80m2 2-BEDROOM FLAT

RENTING PRICES/MONTH FOR A 100m2 3-BEDROOM FLAT

PURCHASE PRICES FOR A 80m2 2-BEDROOM FLAT

PURCHASE PRICES FOR A 100m2 3-BEDROOM FLAT

PURCHASE PRICES FOR A 100m2 2-BEDROOM VILLA

PURCHASE PRICES FOR A 150m2 3-BEDROOM VILLA

If you would like to find out how much you can afford to spend on buying a property in Portugal, please consult our article : Real Estate Budget Estimate | The 6 Steps to define your Investment Potential

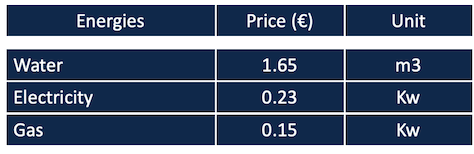

COST OF LIVING IN PORTUGAL | ENERGY

In Portugal, energies are quite expensive, especially electricity. Take this into account when calculating your budget or choosing your accommodation.

ENERGY PRICES

COST OF LIVING IN PORTUGAL | TAXES

As everywhere, there are many taxes in Portugal levied by the state. The main one is the IRS (Imposto sobre o Rendimento de Pessoas Singulares), which corresponds to income tax.

If you would like to find out about the different taxes applied by the Portuguese government, read our article : Portugal Taxes | The 12 main taxes | How to calculate them | How to limit your tax charge?

Personal Income Taxes

This tax concerns all persons who receive a salary from a professional activity in Portugal as well as all pensioners who have their main residence in Portugal.

If you do not have the RNH status

The IRS tax is levied directly at source, either as a deduction from your salary or from your pension. It is the responsibility of the company in which you are employed to make the tax deduction from your income.

The calculation of the IRS tax will depend on 3 factors:

- your level of income

- your marital situation

- whether or not you have children

The Portuguese tax authorities have drawn up tables for each of these cases. The amount to be paid varies according to your income and is progressive.

Tabelle 2020 – If you are not married

Tabelle 2020 – If you are a married couple

The other tables are available on the Finance Portal website

Example of IRS tax calculation

The tax is levied on the gross monthly salary, deducted from the relevant allowance.

The tax rate is applied to the amount of net salary obtained.

You must then select from the table the % tax rate corresponding to your net monthly income and the number of dependent children.

If you own property and receive income in the form of rentals, you are also subject to IRS tax.

In this case, the rate applied is 28% on the total amount of rent received over a year, deducted from the maintenance costs of the property and from property tax (IMI).

If you have RNH status

If you have RNH status as a retired person, the tax rate on your retirement pension is 10% over a period of 10 years.

If you have RNH status as an active person, the tax rate on your income is 20% over a period of 10 years.

To find out exactly what you need to do to obtain the RNH status, we can read our complete article : RNH Portugal Status | What benefits | Fo whom | How to get it

COST OF LIVING IN PORTUGAL | HEALTH INSURANCE

In Portugal, there are two health systems that coexist:

- the public health system

- the private health system

Both models offer +/- the same level of service quality and modern infrastructure.

The big difference lies in the speed of patient care. Indeed, in the public health system, it is not uncommon to have to wait several hours in the emergency services. Similarly, a patient may have to wait several months before being admitted to hospital for a medical or surgical procedure. This is not the case for the private health care system.

Public health care system

The costs are covered by the Portuguese social security system. The patient only has to pay a co-payment depending on the consultation:

EUR 4.50 for the consultation with the family doctor

EUR 7.00 for consultation with a specialist doctor

EUR 14.00 for a doctor’s emergency service

EUR 16.00 for the emergency service of a surgeon

Medication is partially covered depending on the treatment.

Private health care system

In order to benefit from the private health care system, you need to take out insurance with a specialised institute. The amount of insurance to be paid will depend on the health cover chosen and the age of the person. For an adult, the average cost is EUR 20.00 per month per person.

COST OF LIVING IN PORTUGAL | TELECOMMUNICATIONS

The telecommunications offer is dense in Portugal. It offers the same level of quality of service that we know in Europe. 5G is in the process of being activated in 2020.

In terms of device prices, there are few differences with countries such as UK, France, Switzerland or Belgium for the leading brands.

As far as subscriptions are concerned, several types of packages are offered by operators. On average, you can expect an amount of EUR 45.00 per month for the mobile phone + internet.

COST OF LIVING IN PORTUGAL | MOBILITY

Transport is also an important part of a household’s expenditure. In Portugal, costs are relatively low, especially for public transport.

COST OF LIVING IN PORTUGAL | RESTAURANT

Going to restaurants is very common in Portugal. There are 2 explanations for this: Portuguese cuisine is excellent and the prices are very affordable.

Prices vary from region to region and city to city. Here are some examples of prices for a menu with a main course, soup or dessert and coffee.

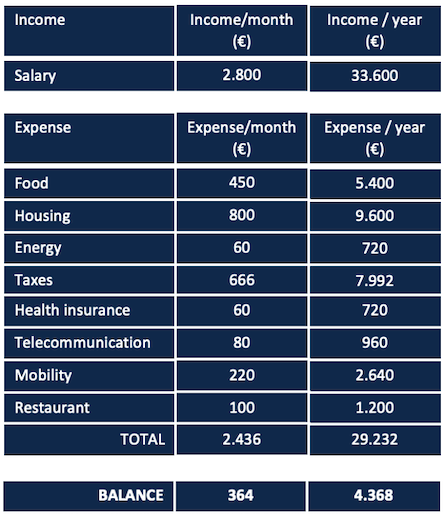

COST OF LIVING IN PORTUGAL | PURCHASING POWER

Now that you have a clearer idea of the costs of daily life in Portugal, what’s left in your wallet at the end of the month?

Here is a simulation of 3 scenarios:

- the couple with 2 children

- the childless couple

- the person who lives alone

Couple with 2 children

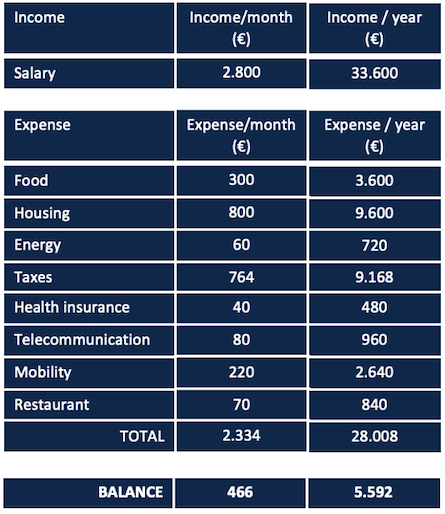

Couple without children

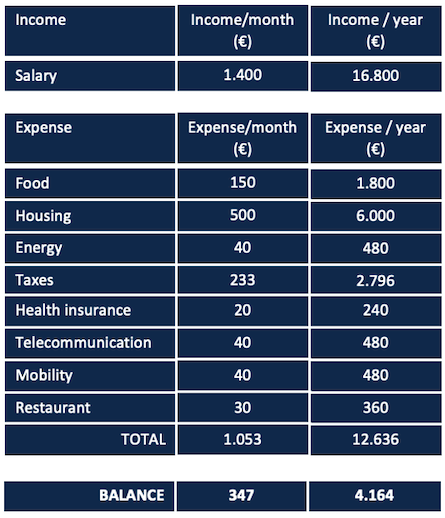

Single person

Thank you for taking the time to read our article through to the end.

If you would like to receive further useful information in preparation for or when buying your property, we invite you to subscribe to our Newsletter. Every month, you will receive a complete file with a wealth of other essential advice to consider before you buy your property.

You can subscribe by clicking on the blue button below.

We look forward to having you as one of our subscribers.

See you soon

VIE D’AZUR